You can walk in to any KWSP office to submit the KWSP 9C AHL D8 Withdrawal Form along with the supporting documents or submit via postal services. Building a home is a major.

39 Kwsp Account 2 Withdrawal For House Renovation Pictures Kwspblogs

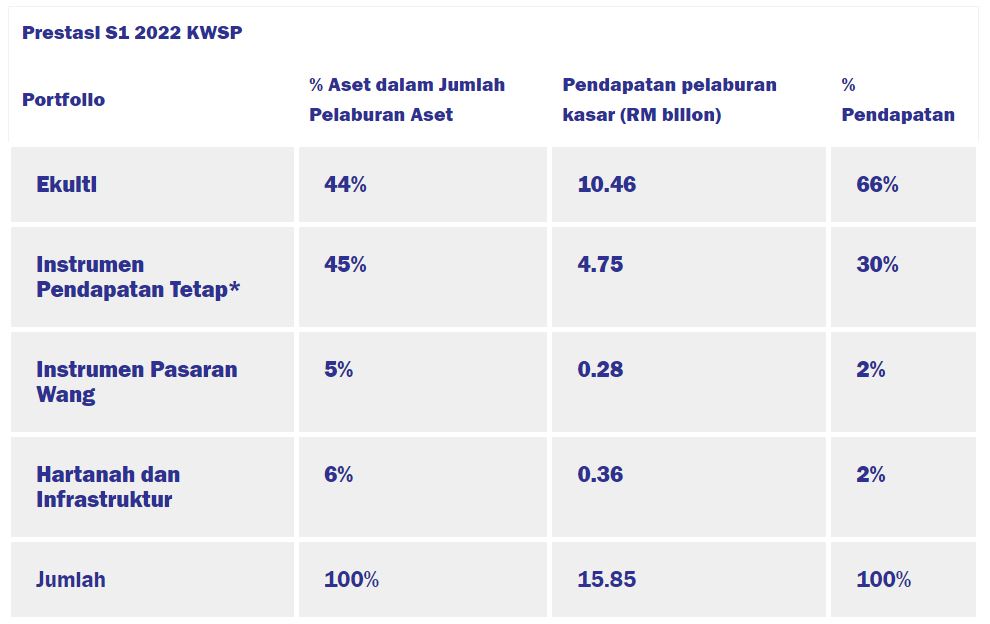

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

. You must be an active EPF subscriber for at least 10 years. TO PURCHASE OR BUILD A HOUSE UNDER THE WITHDRAWAL SCHEME. You do not have arrears for your housing loan.

The house youre going to improvemodify should be at least 5 years. TO PURCHASE OR BUILD A HOUSE UNDER THE WITHDRAWAL SCHEME. Amount eligible to withdraw.

KWSP - EPF Withdrawals Withdrawals To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Partial Withdrawal Full Withdrawal Home Member Withdrawals. This withdrawal allows you to utilize your savings from Account 2 to partially finance your purchase of a house individually OR jointly with your spouse or close family members namely parents or siblings.

The amount is also limited to what you have in. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your. EPF allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education.

You still have a balance in Account 2 of at least RM60000. You can withdraw the difference between the SPA house price and the housing loan amount which is typically 90 as most first time home buyers have to submit a 10 down payment plus 10 on the price of the house. This scheme allows members to withdraw from their account II to purchase or build a house or shop house with a dwelling unit.

Buying of a house with another individual who has no kinship is allowed provided that the other individual is a buyer and borrower. The employee can withdraw funds from his EPF account for the purpose of renovation and reconstruction The house should be held in hisher name or held jointly with the spouse The employee must complete at least 5 years of total service The member can withdraw 12 times his monthly salary from his Provident fund account. Building a home is a major.

This scheme allows members to withdraw from their account II to purchase or build a house or shop house with a dwelling unit. Bangunan KWSP Jalan Raja Laut 50350 Kuala Lumpur Email. Eligibility Criteria For EPF Withdrawal For ImprovingModifying Existing House Well there are two criteria under this improvisation- 1.

KWSP Form 9P AHL A photocopy of myKadIC. This means that if you applied on say 16 April 2018 you cannot apply to withdraw again until 16 April 2019. 2 rows Withdrawals.

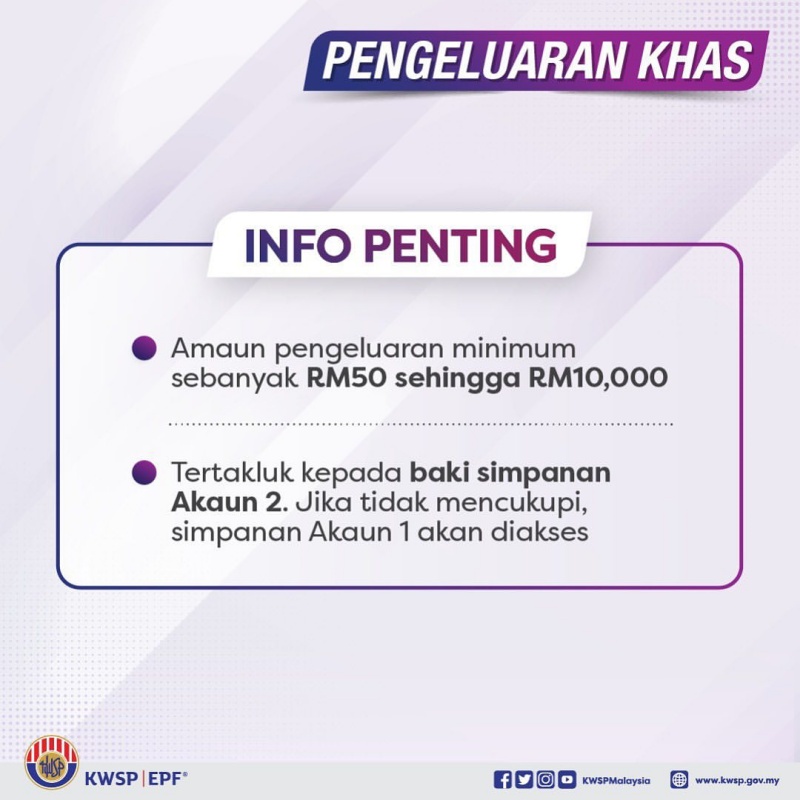

Withdrawal limits The entire housing loan balance Any withdrawal amount is always subject to whatever money is available in the applicants and where applicable joint applicants Account 2. The maximum age allowed for application of this withdrawal is 54 years and 6 months. However on the safer side wait for it to turn more than 5 years.

Documents required For the first withdrawal you are required to submit all of the following. For example housing loan withdrawals are only allowed once a year and only from your Account 2 funds.

Sunfert Epf Funding For Fertility Treatment

Employees Provident Fund Malaysia Wikiwand

Kwsp Housing Loan Monthly Installment

Kwsp Epf Partial Withdrawal Buy Home

Petition Allow One Off Rm10k Kwsp Epf Malaysia Final Withdrawal From Account Due To Cov19 Impact Change Org

How To Withdraw Epf As An Ex Citizen Residing Outside Of Malaysia By Vern Chan Medium

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Epf Application For Rm10 000 Special Withdrawal Starts From April 1 2022 Malay Mail

Governmet Urges Higher Epf Withdrawal For First Time Homebuyers

The Pros And Cons Of Taking The Epf I Sinar Withdrawal Facility

Malaysians Can Now Fund Ivf With Epf Withdrawals Infertility Aide

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Everything You Need To Know About The Latest Epf Special Withdrawal Hype Malaysia